Earlier this month, I received a note from a professor at the University of Hong Kong’s Department of Politics and Public Administration. He invited me to share what I’ve been witnessing at work on the subject of sanctions and how it’s shaping global business.

The lecture went well, and it only feels right to share some of those observations here.

It will be a data-driven newsletter this time around.

The Hyper-Inflation of Sanctions

According to the latest Global Sanctions Index (GSI), released by LSEG Risk Intelligence, 82,000 individuals and entities are now under explicit sanctions worldwide.

That’s not a typo.

Since 2017, the number of sanctioned persons has grown 445%. Annual “sanctions inflation,” the GSI’s term for year-on-year growth, still runs at 17.1%.

The implication is simple but uncomfortable: we’re witnessing the hyper-inflation of sanctions.

The Index That Measures Sanctions Like Inflation

The GSI treats sanctions growth the way economists treat price inflation - as a running indicator of intensity. Using LSEG’s World-Check database, it tracks net new designations, stripping duplicates across lists to reveal true global volume.

The result is an index value of 445, up from 100 in 2017. In other words, the sanctioned population has more than quadrupled.

A few details caught my eye:

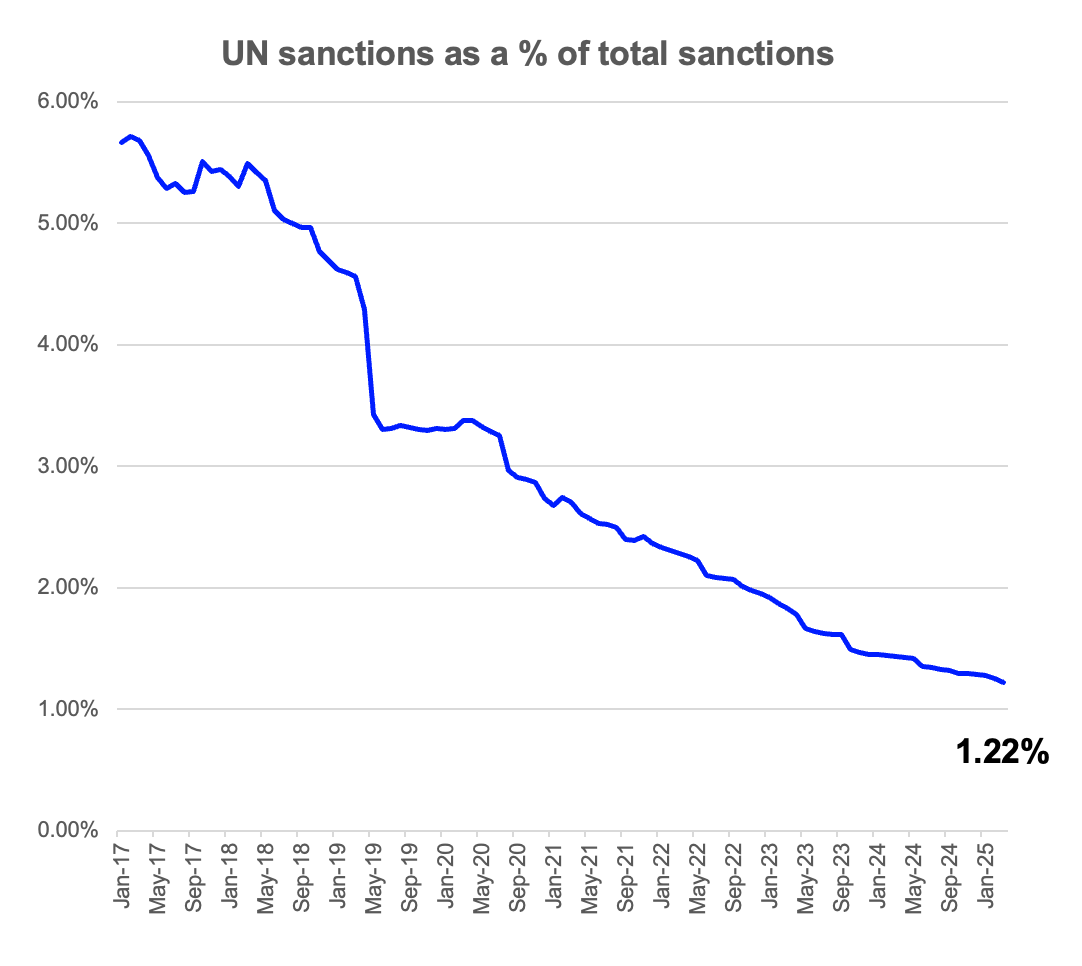

UN sanctions: stagnant at 0.2% annual growth — just 1.22% of global total.

U.S. (OFAC): still the pace-setter, 21% annual inflation.

China: the breakout story — 153% annual inflation, albeit from a low base.

EU: 10.5 % inflation, down from 16.7% a year ago.

Russia and Ukraine: both still expanding their own reciprocal regimes.

The takeaway: almost 99% of sanctions today are “autonomous”, issued outside the UN framework. The consensus era of 9/11-style unity has fractured beyond recognition.

From Consensus to Chaos

In 2001, the world was in agreement that terrorist financing is the enemy. The UN sanctions was used at large and had its day in the sun. Not anymore. Enter UN veto voting mechanism. As the result, UN sanctions inflation is at all-time low: 0.2% YoY with UN sanctions at 1.22% of total.

Today, that consensus has splintered into what the GSI team calls hyper-divergence: a world of competing sanctioning blocs.

Washington is now re-negotiating parts of its Russia program.

Europe, meanwhile, is doubling down.

China and Russia are both issuing counter-lists.

The UN’s share of total sanctions is at its lowest in history.

Add to that the new secondary tariffs created under Executive Order 14245 (March 2025), which empowers the U.S. to impose 25 % tariffs on any country buying Venezuelan oil, effectively merging trade and sanctions policy.

The result is a world where no one quite agrees who the villain is, but everyone’s paying higher compliance costs to prove they aren’t one.

The Mega-Trends Behind the Numbers

LSEG identifies eight long-range trends shaping this inflationary cycle:

Hyper-inflation – Sanctions are expanding faster than they can be enforced.

Divergence – The global consensus is splintering into regional agendas.

Complexity – Every new tool adds layers of exceptions and guidance.

Extraterritoriality – Secondary sanctions and tariffs push reach beyond borders.

Privatisation – Governments now outsource target-identification to the private sector through “category” definitions.

Immediacy – Expectations for near-instant blocking actions; the EU’s 2024 Instant Payments Regulation demands immediate sanctions screening.

Exotic Sanctions – From BIS “address-only” restrictions to family-based listings.

Uncertainty – No one knows which sanctions will tighten, merge, or evaporate next.

Together, they form what might be called the sanctions paradox: the more states rely on sanctions, the less predictable and less coordinated they become.

For Compliance Teams: Reading the Inflation

Sanctions inflation isn’t just a geopolitical headline; it’s an operational cost center.

Each new designation multiplies screening load, false-positive rates, and alert fatigue.

At 17% annual inflation, a program that screens 1 million names this year will process 1.17 million next year. Without a single new customer.

Practical lessons:

Design your screening architecture – choose which regimes matter; “select all” is no longer viable.

Invest in automation and native-language screening – speed now equals compliance.

Own the program – each control needs a clear, empowered owner (“1.5 line”).

Align ops and policy KPIs – timeliness and precision are no longer trade-offs.

Parting Thoughts

Sanctions once marked global unity. Today they mark division. Nearly 99% of all listings now come from autonomous regimes, each acting alone, each adding friction.

That’s not coordination; it’s competition disguised as compliance.

One way to think of the GSI: the age of consensus is over, and sanctions have become a language every nation speaks differently.

What’s your interpretation?

Thanks for reading.

Alexey